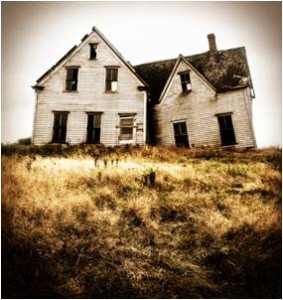

Last summer, Governor Chris Christie signed two bills that allow New Jersey municipalities to regulate vacant and abandoned residential properties in foreclosure proceedings. Municipalities may regulate the care, maintenance, security, and upkeep of these properties.

As previously reported on this blog, P.L. 2014 c. 5, which took effect on July 14, 2014, authorizes municipalities to impose monetary penalties on creditors that fail to abate nuisances on vacant properties. According to the amendment, it requires that creditors notify the municipal clerk of the municipality when serving a summons and complaint within 10 days of service in an action to foreclose. Before imposing any penalties, municipalities must provide notice to the creditor and allow the creditor the opportunity to cure the violation. Penalties may include a fine not to exceed $2,000 and imprisonment for not more than 90 days.

Effective in August 2014, P.L. 2014, c.35 specifically authorizes the governing body of a municipality to adopt ordinances to impose fines on creditors for failing to maintain vacant and abandoned properties. Any ordinances adopted pursuant to the bill must also provide that a creditor filing the summons and complaint in a foreclosure action is responsible for the care, maintenance, security, and upkeep of the exterior of the vacant and abandoned residential property.

Additionally, any out-of-state creditors are subject to these penalties. Out-of-state creditors must appoint a local representative or agent to act for the foreclosing creditor. Through the required notice, the out-of-state creditor must provide the full name and contact information to the municipal clerk of the municipality in which the property is located. If the bank fails to appoint an in-state representative to oversee the property, it is subject to a fine of $2,500 for each day of the violation. If you have not done so already, we recommend talking to your municipal counsel about implementing these new manners to ensure creditors remedy code violations.

For more information about the new foreclosure law or the legal issues involved, we encourage you to contact a member of Scarinci Hollenbeck’s Government Law Group.